Dietary Supplements Market Size Expected to Reach USD 430.39 Bn by 2034 Driven by Preventive Healthcare, Personalized Nutrition, and Rising Health Awareness

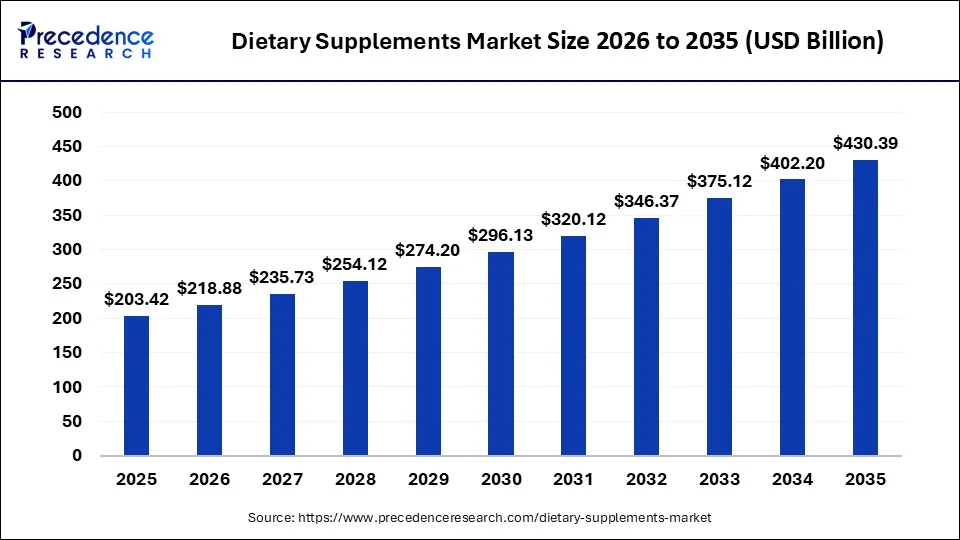

The global dietary supplements market size is calculated at USD 203.42 billion in 2025 and is expected to grow from USD 218.88 billion in 2026 to USD 430.39 billion by 2034, with a CAGR of 7.78% from 2025 to 2034. The increased awareness about health and growing nutritional deficiencies drive the market growth.

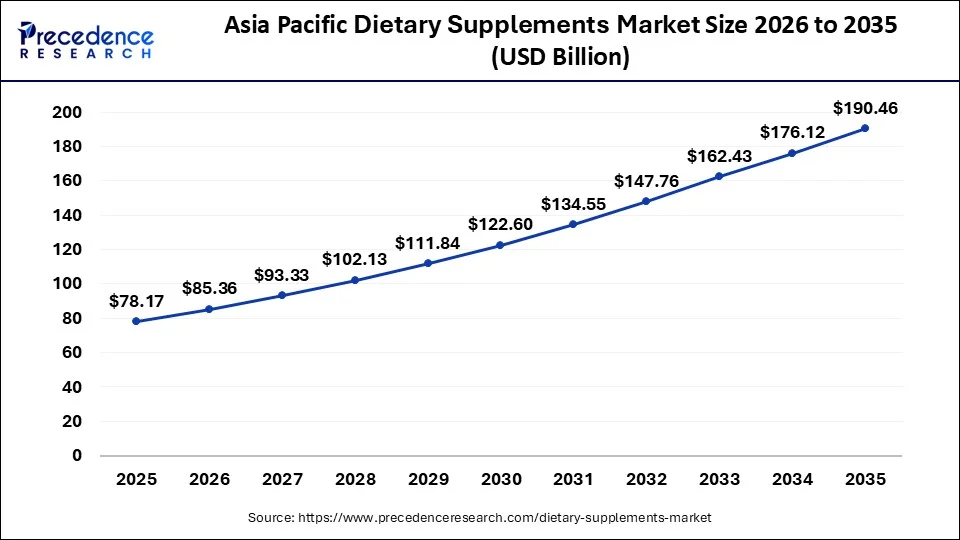

Ottawa, Dec. 17, 2025 (GLOBE NEWSWIRE) -- According to Precedence Research, the global dietary supplements market size is expected to reach nearly USD 430.39 billion by 2034, increasing from USD 218.88 billion in 2026. The market is expected to expand at a strong compound annual growth rate (CAGR) of 7.78% from 2026 to 2035. Asia Pacific led the global market with a 37.86% share in 2025, while North America stands out as the fastest-growing region.

The Full Study is Readily Available | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/1211

Dietary Supplements Market Highlights:

-

By Region: Asia Pacific dominated the market in 2025, capturing 37.86% of the total revenue share, while North America emerged as the fastest-growing region during the forecast period.

-

By Ingredient: Vitamins led the market with a 31.80% revenue share in 2025. Meanwhile, the botanicals segment is projected to grow at a CAGR of 8.95%, and proteins & amino acids are expected to expand at a CAGR of 8.36% (2026–2035).

-

By Form: Tablets held the largest share, accounting for 32.63% of revenue in 2025, whereas the liquid supplements segment is gaining momentum, growing at a CAGR of 9.40% during 2026–2035.

-

By Application: The immunity segment continues to be a key growth driver and is anticipated to register a CAGR of 6.87% over the forecast period.

-

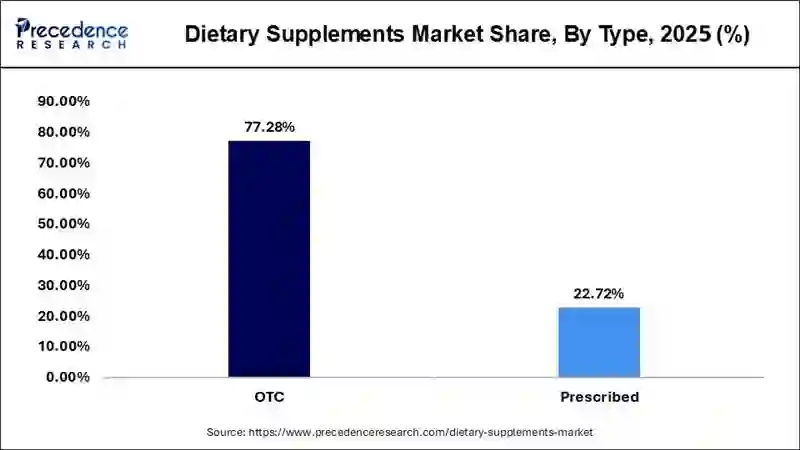

By Type: OTC dietary supplements dominated the market with a 77.28% revenue share in 2025, while the prescribed supplements segment is forecast to grow rapidly at a CAGR of 9.47%.

-

By End User: The adult population represented the largest consumer base, accounting for 45.96% of total revenue in 2025.

-

By Distribution Channel: The offline channel maintained its strong position, holding over 68.90% of market revenue in 2025, supported by consumer trust and professional recommendations.

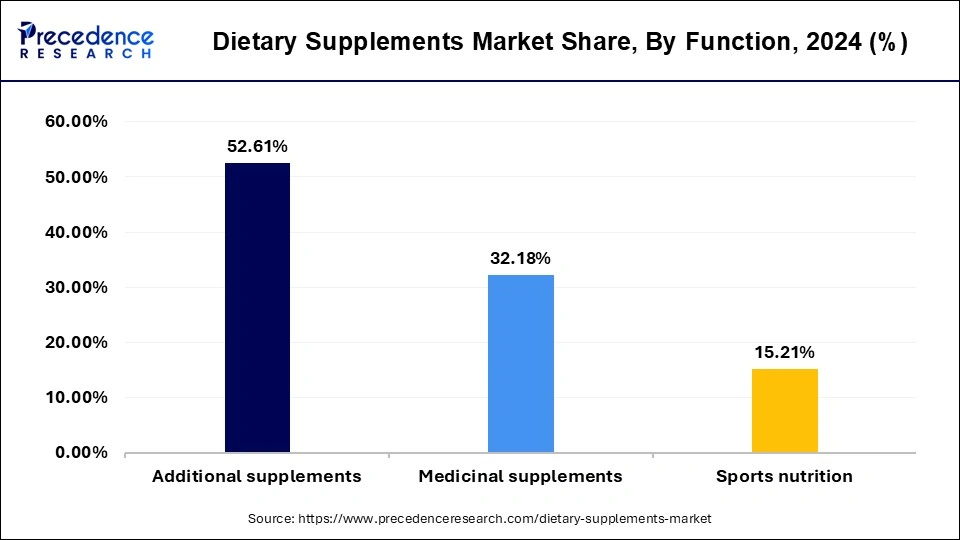

- By Function: Additional supplements led the market, contributing approximately 52.61% of total revenue in 2025.

What are Dietary Supplements?

The dietary supplements market growth is driven by the high consumption of multivitamins, the increased importance of wellness, focus on preventing diseases, growing chronic diseases, increased need for personalised nutrition, and high spending on supplements.

A dietary supplement is a product that supplements a person’s diet and is available in forms like capsules, gummies, powders, softgels, pills, & liquid. The supplement contains dietary ingredients like minerals, botanicals, enzymes, concentrates, vitamins, amino acids, herbs, probiotics, and extracts. The examples of dietary supplements are fish oil, calcium, folic acid, melatonin, vitamin D, iron, and others.

➡️ Become a valued research partner with us https://www.precedenceresearch.com/schedule-meeting

Government Initiatives for the Dietary Supplements Industry:

- Mandatory Product Listing (MPL): In the U.S., the FDA and other stakeholders are advocating for mandatory product listing, which would require all manufacturers to submit information about their products and ingredients before marketing, providing greater market visibility and oversight.

- Current Good Manufacturing Practices (cGMP): Regulatory bodies like the U.S. FDA enforce strict cGMP guidelines that require manufacturers to establish specifications for the identity, purity, quality, strength, and composition of their supplements to ensure product quality and consistency.

- Harmonized Trade Codes: The Indian government's Nutraceutical Sector Task Force introduced specific Harmonized System of Nomenclature (HSN) codes for nutraceuticals to streamline trade processes and support the industry's growth in export markets.

- Regulation of Health Claims: In both the U.S. and the EU, government agencies (FDA and FTC in the U.S.; EFSA and the European Commission in the EU) strictly prohibit the labeling or advertising of supplements as treatments or cures for diseases, requiring all claims to be truthful, substantiated by scientific evidence, and not misleading.

-

Promoting Indigenous Medicine: Initiatives by bodies such as India's Ministry of AYUSH aim to promote traditional herbal and Ayurvedic supplements through collaborations and research, capitalizing on the country's rich heritage of natural ingredients to boost the local industry.

Built for leaders who move markets. Access live, actionable intelligence with Precedence Q. https://www.precedenceresearch.com/precedenceq/

Key Dietary Supplements Market Trends

- Personalized Nutrition: Driven by advancements in artificial intelligence and genetic testing, consumers are seeking customized supplements tailored to their specific health needs and genetic profiles. This reflects a shift from "one-size-fits-all" multivitamins to highly targeted solutions that improve efficacy and consumer loyalty.

- Plant-Based and Clean-Label Products: Consumers are increasingly prioritizing supplements made from natural, organic, and sustainably sourced ingredients, free from artificial additives. This trend is fueled by growing health consciousness and environmental concerns, pushing manufacturers to adopt greater transparency in their sourcing and manufacturing processes.

-

Targeted Health Solutions: There is a growing demand for supplements that address specific health concerns beyond general wellness, such as cognitive function, stress management, and gut microbiome balance. This interest in condition-specific ingredients like probiotics, adaptogens (ashwagandha), and nootropics has led to innovative product development in areas like mental and digestive health.

Dietary Supplements Market Opportunity

Growing Nutritional Deficiencies Surge Dietary Supplement Demand

The busy lifestyle of consumers and high reliance on processed & packaged food create nutritional deficiency issues. The poor food choices of consumer and increasing shortfalls of nutrients increases demand for dietary supplements. The sedentary lifestyle and high prevalence of cardiovascular diseases, obesity, & diabetes increase demand for dietary supplements.

The growing veganism and growing health consciousness among consumers increase the adoption of dietary supplements. The lower nutrient absorption in adults increases demand for dietary supplements like calcium, vitamin D, and B12. The growing iron deficiency and a strong focus on mental sharpness increase demand for dietary supplements. The growing nutritional deficiencies create an opportunity for the dietary supplement market.

Get informed with deep-dive intelligence on AI’s market impact https://www.precedenceresearch.com/ai-precedence

Dietary Supplements Market Report Coverage

| Market Scope | Details |

| Market Size in 2025 | USD 203.42 Billion |

| Market Size in 2026 | USD 218.88 Billion |

| Market Size by 2035 | USD 430.39 Billion |

| Growth Rate (2026–2035) | CAGR of 7.78% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Historical Data Considered | 2021–2024 |

| Key Growth Drivers | Rising health consciousness, preventive healthcare adoption, aging population, lifestyle-related disorders |

| Major Market Trends | Shift toward plant-based & clean-label supplements, personalized nutrition, sports & fitness nutrition demand |

| Popular Product Categories | Vitamins, Minerals, Proteins & Amino Acids, Herbal Supplements, Omega Fatty Acids, Probiotics |

| Preferred Forms | Tablets, Capsules, Powders, Gummies, Liquids |

| Key Applications | Immunity support, bone & joint health, energy & metabolism, digestive health, heart health |

| End Users | Adults, Geriatric Population, Pregnant Women, Children, Athletes |

| Distribution Channels | Pharmacies & Drug Stores, Online Retail, Supermarkets/Hypermarkets, Specialty Stores |

| Technology & Innovation Focus | Personalized supplements, AI-driven nutrition solutions, advanced bioavailability formulations |

| Regulatory Landscape | Stringent quality standards, labeling compliance, growing emphasis on safety & efficacy |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

| High-Growth Region | Asia Pacific, driven by urbanization, rising disposable income, and expanding middle-class population |

| Competitive Landscape | Presence of global brands, rising private labels, and increasing strategic partnerships & acquisitions |

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1211

Dietary Supplements Market Regional Outlook

How Big is the Asia Pacific Dietary Supplements Market?

The Asia Pacific dietary supplements market is experiencing robust growth, with its value reaching USD 78.17 billion in 2025 and expected to surge to approximately USD 190.46 billion by 2035. This expansion reflects a strong CAGR of 9.31% between 2026 and 2035, driven by rising health awareness, preventive healthcare adoption, and increasing consumer demand across the region.

Why Asia Pacific Dominates the Dietary Supplements Market?

Asia Pacific dominated the market in 2024. The growing population, particularly in countries like Japan, China, & India, and increased health consciousness among consumer increases demand for dietary supplements. The growing popularity of fitness activities and increased awareness about the consumption of ashwagandha, turmeric, & other ingredients increase demand for dietary supplements. The rapid growth in e-commerce and the development of specialized supplements drive the overall market growth.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Try Before You Buy – Get the Sample Report@ https://www.precedenceresearch.com/sample/1211

India Dietary Supplements Market Trends

The India market is witnessing strong growth, driven by rising health awareness, increasing preventive healthcare adoption, and a growing focus on immunity and overall wellness. Urbanization, higher disposable incomes, and lifestyle-related health concerns such as stress, obesity, and nutritional deficiencies are boosting demand for vitamins, minerals, protein supplements, and herbal products. The influence of Ayurveda and natural ingredients continues to shape consumer preferences, with plant-based and clean-label supplements gaining traction.

How is North America experiencing the Fastest Growth in the Dietary Supplements Market?

North America is experiencing the fastest growth in the market during the forecast period. The increased awareness about preventive healthcare and growing age-related concerns increases the consumption of dietary supplements. The rising prevalence of chronic disorders and focus on personalised nutrition increases demand for dietary supplements. The shift towards clean-label and organic options and growing online sales of dietary supplements support the overall market growth.

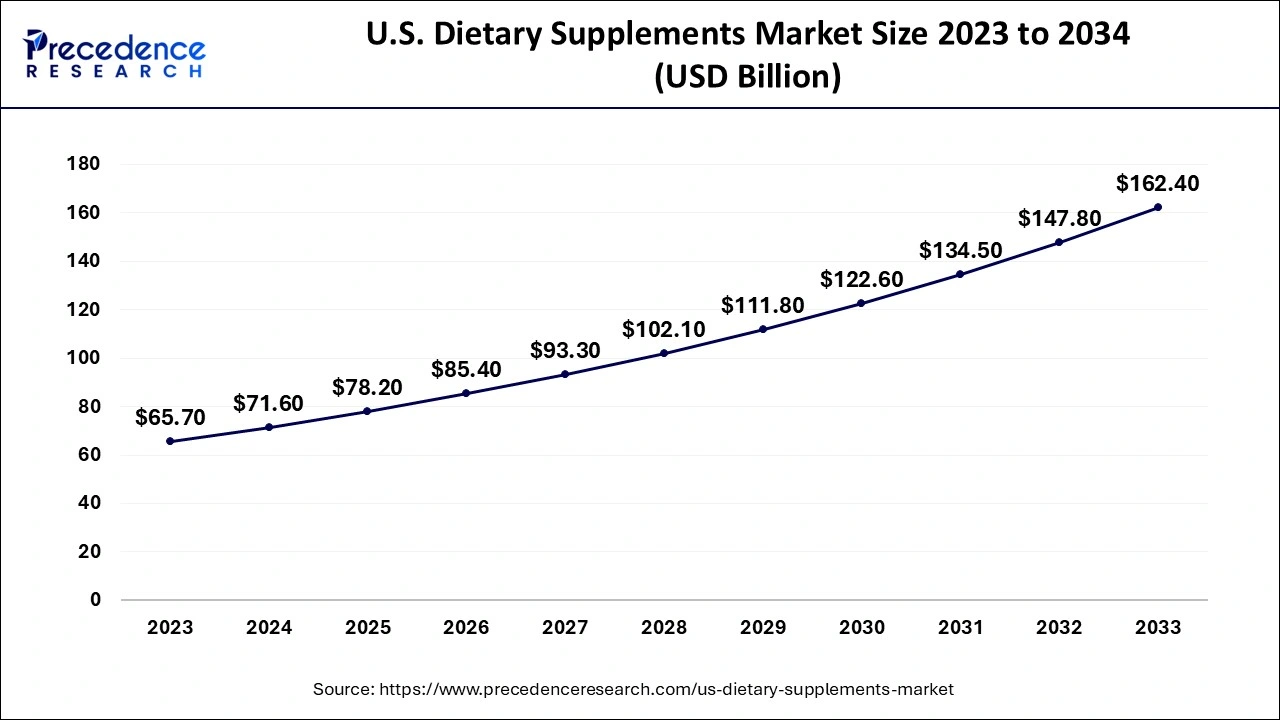

What is the U.S. Dietary Supplements Market Size and Growth Rate?

The U.S. dietary supplements market size was valued at USD 78.20 billion in 2025 and is projected to rise from USD 85.40 billion in 2026 to nearly USD 162.40 billion by 2033, growing at a healthy CAGR of 9.47% from 2024 to 2033. The rising geriatric population in the country and the demand for preventive and nutrition supplements are driving the growth of the U.S. dietary supplements market.

U.S. Dietary Supplements Market Trends

The U.S. market is experiencing steady growth, supported by strong consumer awareness of health, wellness, and preventive care across all age groups. Rising demand for immunity-boosting, heart health, digestive health, and mental wellness supplements is shaping product innovation and portfolio expansion.

Consumers are increasingly favoring clean-label, organic, plant-based, and scientifically backed formulations, driving transparency and quality assurance among manufacturers. The expansion of e-commerce, subscription-based models, and personalized nutrition solutions is enhancing product accessibility and consumer engagement.

U.S. Dietary Supplements Market Key Insights:

- By ingredient, the vitamins segment held the largest market share of 44.6% in 2023.

- By ingredient, the botanical segment is expected to grow at a CAGR of 9.3% during the predicted period.

- By form, the tablet segment accounted for the highest market share of 32.7% in 2023.

- By type, the OTC segment contributed the biggest market share of 74% in 2023.

- By type, the prescribed segment is projected to grow at a notable CAGR of 9.6% during the forecast period.

- By function, the additional supplements segment generated the highest market share of 54.5% in 2023.

- By application, the energy and weight management segment captured more than 20% of market share in 2023.

- By application, the prenatal health supplements segment is predicted to witness significant growth in the market over the forecast period.

- By distribution channel, the offline segment recorded the highest market share of 68% in 2023.

- By distribution channel, the online segment is predicted to expand at a fastest CAGR of 8.7% over the forecast period.

- By end-user, the adult segment led the market with the largest market share of 46% in 2023.

U.S. Dietary Supplements Market Leading Companies

- Bayer

- NBTY Inc

- Bionova Lifesciences

- Nu Skin Enterprises

- Carlyle Group

- Pfizer

- Arkopharma Laboratoires Pharmaceutiques

- Glanbia

- Herbalife International

- Abbott Laboratories

- GlaxoSmithKline

- Nature's Sunshine Forms

- Amway

- Archer Daniels Midland

Built for leaders who move markets. Access live, actionable intelligence with Precedence Q. https://www.precedenceresearch.com/precedenceq/

Dietary Supplements Market Segmentation Insights

Ingredient Insights

Why the Vitamins Segment Dominates the Dietary Supplements Market?

The vitamins segment dominated the market in 2024. The growing consumption of modern diets and focus on proactive wellness increases demand for vitamins. The increasing need for the prevention of chronic diseases and focus on boosting immunity increases demand for vitamins like B complex, C, & D. The growing youth population and rising popularity of fitness increase demand for vitamins.

The botanicals segment is the fastest-growing in the market during the forecast period. The increasing health consciousness among consumers and growing veganism increases demand for botanicals. The strong focus on overall well-being and transition towards preventive healthcare increases the adoption of botanicals. The growing consumption of green tea, ashwagandha, echinacea, and valerian supports the overall growth of the market.

Dietary Supplements Market Revenue (USD Billion), By Ingredients 2022 to 2024

| Ingredients | 2022 | 2023 | 2024 |

| Vitamins | 52.6 | 56.2 | 60.2 |

| Minerals | 23.9 | 25.7 | 27.7 |

| Fibers & Specialty Carbohydrates | 17.6 | 18.6 | 19.7 |

| Omega Fatty Acids | 20.3 | 21.9 | 23.7 |

| Botanicals | 16.3 | 17.7 | 19.2 |

| Proteins & Amino Acids | 18.7 | 20.2 | 21.8 |

| Others | 14.7 | 15.8 | 16.9 |

Form Insights

How did the Tablets Segment hold the Largest Share in the Dietary Supplement Industry?

The tablets segment held the largest revenue share in the dietary supplements industry in 2024. The cost-effective manufacturing and dosage accuracy of tablets help market growth. The growing need for extended release, quick release, and delayed release increases the adoption of tablets. The availability of tablets in forms like bilayer, coated, & chewable drives the market growth.

The liquids segment is experiencing the fastest growth in the market during the forecast period. The increasing need for quick energy among fitness enthusiasts and the growing elderly population increases demand for liquid supplements. The strong focus on enhancing brain health and growing prenatal care increases the consumption of the liquid form. The ease of use, faster absorption, versatility, and convenience of liquid form support the overall market growth.

Dietary Supplements Market Revenue (USD Billion), By From 2022 to 2024

| Form | 2022 | 2023 | 2024 |

| Capsules | 35.4 | 37.7 | 40.3 |

| Tablets | 53.2 | 57.3 | 61.7 |

| Gummies | 17.8 | 19.5 | 21.3 |

| Soft gels | 21.3 | 22.9 | 24.8 |

| Liquids | 5.7 | 6.2 | 6.7 |

| Powders | 19.8 | 21.1 | 22.4 |

| Others | 11.1 | 11.5 | 12 |

Application Insights

Why is Immunity Segment Dominating the Dietary Supplements Market?

The immunity segment dominated the market in 2024. The growing risks of infections and a weaker immune system in aged people increase demand for dietary supplements. The strong consumer focus on daily wellness and growing lifestyle disorders requires a dietary supplement. The growing consumption of immune-boosting supplements like vitamin D, antioxidants, ashwagandha, vitamin C, and zinc drives the overall market growth.

The brain or mental health segment is the fastest-growing in the market during the forecast period. The growing level of stress and strong focus on managing anxiety increases demand for dietary supplements. The increasing awareness about mental health and the high prevalence of conditions like Alzheimer’s & dementia increase demand for brain & mental health supplements, supporting the overall market growth.

End User Insights

Which End User held the Largest Share in the Dietary Supplements Industry?

The adult segment held the largest revenue share in the dietary supplements industry in 2024. The adults' focus on managing weight and preventing diseases increases demand for dietary supplements. The poor dietary choices of adults and higher risks of obesity increase the adoption of dietary supplements. The adults' willingness to spend on dietary supplements like omega-3, multivitamins, calcium, and minerals drives the overall market growth.

The pregnant women segment is experiencing the fastest growth in the market during the forecast period. The increasing awareness about the importance of nutrition for the development of fetal and the need for preventing severe defects in births increases demand for dietary supplements. The growing consumption of supplements for maternal tissue growth and a higher need for amino acids, vitamins, iron, & minerals in pregnancy supports the overall market growth.

Type Insights

How the OTC Segment Dominated the Dietary Supplements Market?

The OTC segment dominated the market in 2024. The strong consumer focus on self-care and growing concerns like digestion issues, sleep disturbance, aging, & others increases demand for OTC. The availability of OTC supplements in online stores, pharmacies, & supermarkets and cost-effectiveness help market growth. The availability of various products like capsules, gummies, vitamins, liquid, and many more on OTC drives the overall market growth.

The prescribed segment is the fastest-growing in the market during the forecast period. The focus on preventing disorders like hypertension, diabetes, and heart disease increases demand for prescribed supplements. The increasing need for maintaining bone health and growing awareness about overall well-being increase demand for prescribed supplements. The trust in doctor-approved supplements supports the overall market growth.

Distribution Channel Insights

Why did Offline Segment hold the Largest Share in the Dietary Supplements Market?

The offline segment held the largest revenue share in the dietary supplements industry in 2024. The increasing awareness about nutrition benefits and a sedentary lifestyle gives preference for purchasing dietary supplements from offline platforms. The consumer trust in doctors and the increasing demand for personalised solutions increase the adoption of offline platforms, driving the overall market growth.

The online segment is experiencing the fastest growth in the market during the forecast period. The busy schedules & lifestyles of consumers and increasing consumption of various brand products increase buying online. The strong focus on shopping anytime and the focus on detailed product information increase the buying online. The social media influence and improved digital infrastructure support the overall market growth.

Function Insights

How Medicinal Segment Dominating the Dietary Supplements Market?

The medicinal segment dominated the market in 2024. The increasing need for preventing lifestyle-related disorders and focus on enhancing mental sharpness increases the demand for dietary supplements. The strong need for boosting immunity and growing interest in organic ingredients help market expansion. The growing demand for addressing micronutrient deficiencies increases demand for dietary supplements, driving the overall market growth.

The sports nutrition segment is the fastest-growing in the market during the forecast period. The growing fitness consciousness among every generation and booming gym memberships increase demand for dietary supplements. The rising interest in maintaining fitness and growing fitness influencers increases the adoption of dietary supplements. The strong focus of sports persons on weight management, muscle building, and endurance increases the adoption of fitness supplements, supporting the overall growth of the market.

Dietary Supplements Market Revenue (USD Billion), By From 2022 to 2024

| Function | 2022 | 2023 | 2024 |

| Additional supplements | 87.7 | 93.4 | 99.5 |

| Medicinal supplements | 52.5 | 56.5 | 60.9 |

| Sports nutrition | 24 | 26.3 | 28.8 |

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1211

✚ Related Topics You May Find Useful:

➡️ Global Nutritional Supplements Market: Explore how preventive healthcare, immunity focus, and lifestyle-driven nutrition are accelerating global supplement adoption

➡️ Personalized Testing and Supplements Market: Discover how AI, genetic testing, and data-driven wellness are reshaping customized nutrition solutions

➡️ Mineral Supplements Market: Analyze rising demand for calcium, iron, and magnesium driven by aging populations and nutrient deficiencies

➡️ Immune Health Supplements Market: See how immunity-focused lifestyles and preventive care trends are fueling supplement innovation

➡️ Nutraceutical Ingredients Market: Gain insights into clean-label, functional, and bioactive ingredients transforming nutraceutical formulations

➡️ Wellness Supplements Market: Track the growing consumer shift toward holistic health, mental wellness, and everyday nutrition

➡️ Pet Food and Supplements Market: Understand how pet humanization and premium nutrition trends are boosting demand worldwide

➡️ Bioactive Ingredients Market: Explore the role of science-backed compounds in functional foods, supplements, and health optimization

➡️ Anti-Aging Supplements Market: Discover how longevity science, collagen demand, and beauty-from-within trends are shaping the market

➡️ Weight Loss Supplements Market: Analyze consumer focus on metabolism, fitness, and healthy weight management driving product innovation

Top Companies in the Dietary Supplements Market & Their offerings:

-

Abbott Laboratories provides science-based nutritional shakes like Ensure and PediaSure for comprehensive dietary management.

-

Amway distributes the organic, plant-based Nutrilite brand of vitamins and supplements through direct sales.

-

Archer Daniels Midland (ADM) supplies functional ingredients such as probiotics and vitamins to other supplement manufacturers.

-

Arkopharma Laboratoires Pharmaceutiques specializes in developing and marketing plant-based, natural herbal supplements in Europe.

-

Bayer offers consumer health multivitamins and daily supplements under major brands like One A Day and Berocca.

-

Bionova Lifesciences manufactures and supplies a variety of nutritional, herbal, and sports supplements, often as a third-party manufacturer.

-

Carlyle Group is an investment firm that has historically bought and sold major supplement businesses like NBTY, Inc.

-

Glanbia produces performance and sports nutrition products, including advanced protein powders, under various brands for athletes.

-

GlaxoSmithKline (GSK) spun off its consumer healthcare and supplement business into a new independent company called Haleon in July 2022.

-

Herbalife International uses a direct-selling model to offer weight management products and meal replacement shakes.

-

Nature's Sunshine Forms (Nature's Sunshine Products) provides a vast range of herbal and natural nutritional supplements focused on wellness.

-

NBTY Inc (now The Bountiful Company) is a major manufacturer of vitamins and supplements under brands like Nature's Bounty and Solgar.

-

Nu Skin Enterprises is a multi-level marketing company that sells anti-aging wellness products via its Pharmanex line of supplements.

- Pfizer exited the consumer health and supplement market by divesting its stake in the Haleon joint venture to focus on pharmaceuticals.

Recent Developments in the Dietary Supplements Industry:

- In June 2025, Dabur launched Siens, a new D2C dietary supplements brand. The product range includes gut health, skin health, and daily wellness supplements. The product ingredients are certified with HACCP, GMP, & ISO, and the brand is available on e-commerce platforms. (Source: https://bestmediainfo.com)

- In August 2025, Nutritunes launched ThymoQuin black seed oil dietary supplement. The supplement is obtainable in two forms: non-organic & organic soft gel. The supplement offers benefits like balanced inflammatory response, mitochondrial activity, and antioxidant support. (Source: https://www.nutritioninsight.com)

- In October 2025, NutriLeads launched a new prebiotic supplement, Wecarrot, for gut & immune health. The supplement consists of ingredients like zinc, benicaros, and vitamins. The supplement consists of 60 capsules for 30 days and doesn’t contain artificial flavors & colors. (Source: https://www.nutritionaloutlook.com)

Dietary Supplements Market Segments Covered in the Report

By Ingredient

- Vitamins

- Minerals

- Fibers & Specialty Carbohydrates

- Omega Fatty Acids

- Botanicals

- Proteins & Amino Acids

- Others

By Form

- Capsules

- Tablets

- Gummies

- Soft gels

- Liquids

- Powders

- Others

By Application

- Energy & Weight Management

- Bone & Joint Health

- Diabetes

- General Health

- Immunity

- Cardiac Health

- Gastrointestinal Health

- Anti-cancer

- Lungs Detox/Cleanse

- Sexual Health

- Brain/Mental Health

- Skin/Hair/Nails

- Insomnia

- Anti-aging

- Menopause

- Prenatal Health

- Others

By End User

- Adults

- Geriatric

- Pregnant Women

- Children

- Infants

By Type

- OTC

- Prescribed

By Distribution Channel

- Offline

- Hypermarkets/Supermarkets

- Pharmacies

- Specialty Stores

- Practioner

- Others

- Online

By Function

- Additional supplements

- Medicinal supplements

- Sports nutrition

By Region

-

North America

- U.S.

- Canada

- Mexico

- Rest of North America

-

South America

- Brazil

- Argentina

- Rest of South America

-

Europe

-

Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

-

Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

-

Western Europe

-

Asia Pacific

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

-

MEA

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

- GCC Countries

Thank you for reading. You can also get individual chapter-wise sections or region-wise report versions, such as North America, Europe, or Asia Pacific.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1211

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

Stay Ahead with Precedence Research Subscriptions

Unlock exclusive access to powerful market intelligence, real-time data, and forward-looking insights, tailored to your business. From trend tracking to competitive analysis, our subscription plans keep you informed, agile, and ahead of the curve.

Browse Our Subscription Plans@ https://www.precedenceresearch.com/get-a-subscription

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

✚ Explore More Market Intelligence from Precedence Research:

➡️ Generative AI in Life Sciences: Explore how AI innovations are revolutionizing drug discovery, research efficiency, and precision medicine.

➡️ Biopharmaceuticals Growth: Understand the accelerating expansion of biologics, therapeutic proteins, and cutting-edge pharma pipelines.

➡️ Digital Therapeutics: Discover how technology-driven treatments are reshaping patient care and improving clinical outcomes.

➡️ Life Sciences Growth: Gain insights into emerging opportunities, market expansion, and innovation trends in the life sciences sector.

➡️ Viral Vector & Gene Therapy Manufacturing: Analyze the production advancements powering next-generation gene therapies and precision medicine.

➡️ Wellness Transformation: See how consumer wellness trends are shaping supplements, functional foods, and lifestyle-driven markets.

➡️ Generative AI in Healthcare: Unlocking Novel Innovations in Medical and Patient Care: Explore AI applications enhancing diagnostics, treatment personalization, and patient engagement.

Our Trusted Data Partners:

Towards Healthcare | Towards Packaging | Towards Automotive | Towards Chem and Materials | Towards FnB | Towards Consumer Goods | Statifacts | Towards EV Solutions | Towards Dental | Nova One Advisor | Market Stats Insight | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Get Recent News:

https://www.precedenceresearch.com/news

For the Latest Update, Follow Us:

LinkedIn | Medium | Facebook | Twitter

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.